How Infrastructure Digital Twins Are Attracting Investor Interest?

The management of assets and projects in the construction and real estate sectors can be revolutionized using digital twins as virtual reproductions of physical assets. By delivering real-time data, as compared to BIM, digital twins revolutionize the management of physical assets in the construction industry. Construction crews can monitor the work, spot problems, and make changes to the plans thanks to these virtual reproductions, guaranteeing that the projects are safe, on schedule, and of high quality.

The Transforming Infrastructure Performance Programme must significantly increase productivity, according to Infrastructure and Projects Authority CEO Nick Smallwood. Better information management during delivery and the development of digital twins for asset maintenance and optimisation are two examples of this.

Digital twins make it simple to move and share data thanks to developments in AI, ML, and predictive analytics. By enabling firms to test new concepts and assets before they are introduced, this technology lowers costs by enabling cost-effective ideas and asset testing. For the advantage of investors and to encourage higher returns on investment, digital twin solutions in the construction industry help with resource planning, logistics, safety monitoring, and resource tracking.

Infrastructure Digital Twins and Investor Interest

Digital twins can help the banking sector increase value, adhere to sustainability objectives, draw new investments, and enhance risk management. By assuring that assets are more advanced digitally when sold again, equity investors want to recover their investment. Demonstrating better performance and lower risk, attracting more value-enhancing investment, and boosting revenues, raises resale value. The importance of digital twins for asset planning has been demonstrated by the Centre for Digital Built Britain (CDBB).

National digital twins and the application of Gemini principles

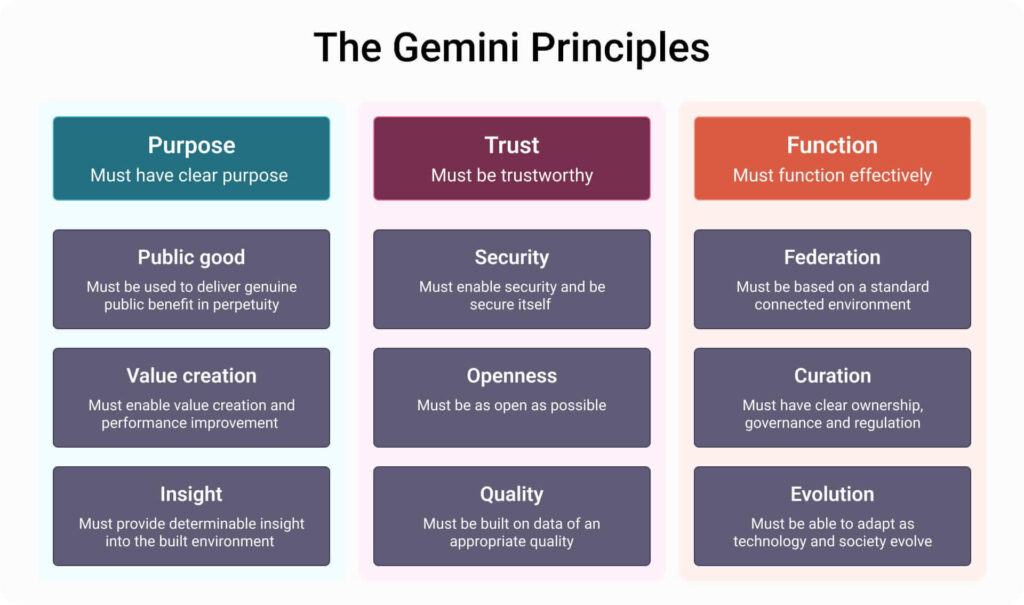

By using data for the benefit of the general public, a national digital twin, an ecosystem of interconnected digital twins, can unleash greater value. The UK’s national digital twin initiative, founded on the Gemini Principles, intends to protect infrastructure data in real-time while maintaining its purpose, dependability, and effective functioning. The Gemini Principles can be accomplished via cooperation. To promote resilient, sustainable, and smart communities, the use of renewable energy, and defence against climate change and sea level rise, Singapore has become the first government to build a national digital twin.

The Gemini Principles, divided into the categories of purpose, trust, and function, are being used to create National Digital Twins (NDT).

- Their objective is to aid in the coordinated production of digital twins by the industry that can be used with NDT.

- Although simple, their consequences are important and challenging, and they encourage adaptability for innovation and development over time.

Information Value Chain for Investors

Infrastructure is generally regarded as a desirable investment since it provides steady, dependable profits that are frequently secured by a government counterparty. Even though data already has value on its own, according to Alexandra Bolton, a former executive director of CDBB, that value rises when it is shared and networked. The Gemini Principles suggest that data must be as open as feasible while adhering to the foundations of complete security to maximize advantage for everyone. Data from numerous sources must be included for digital twins to be as valuable as possible. Collaboration across the information value chain is thus necessary for the infrastructure and finance sectors.

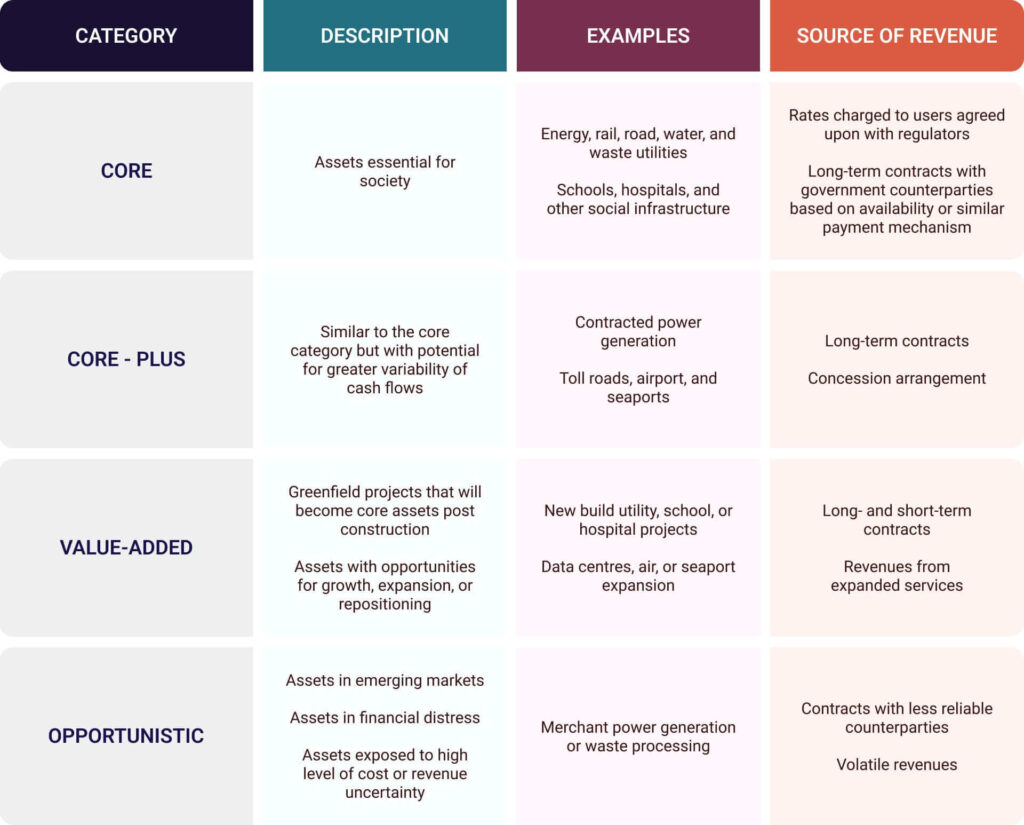

To comprehend how infrastructure is commonly categorized in the finance world and how this can relate to digital twins, many investors categorize the sector’s prospects into four groups, as shown below.

Environmental Social and Governance (ESG) Compliance Requirements for Investors

ESG loans are becoming more prevalent, leading to the development of new financial industry specialities focusing on ESG-related investments. Digital twins will support ESG reporting by providing access, accuracy, and consistency of data. High-quality data should be the foundation of digital twins, as asset management and ESG reporting share common data requirements. Advanced use of digital twins will lead to greater data quality and timely ESG reporting, enhancing asset value and compliance with ESG criteria.

Related Blog:

Need Of The BIM: Digital Twin

Final Words

Building sustainable infrastructure requires cooperation between investors and stakeholders, allowing for better business decisions and positive effects on the economy, society, and environment. By 2040, spending on digital twins is anticipated to be $27.6 billion (Cockerell 2022), necessitating integrating systems for transportation, housing, energy, and healthcare. To improve investment returns, meet ESG standards, and create a sustainable future, the financial sector must collaborate with the greater infrastructure community and solution suppliers. Thus, it can be concluded that investors have a significant untapped potential to influence how data is used to enhance infrastructure decision-making and that playing a bigger role in the digital transformation of infrastructure will benefit businesses, people, and the environment.